At PepTalkHer, we’re on a mission to empower YOU to know your worth and understand your value in the workplace. And what better way to start than asking our favorite women in business?

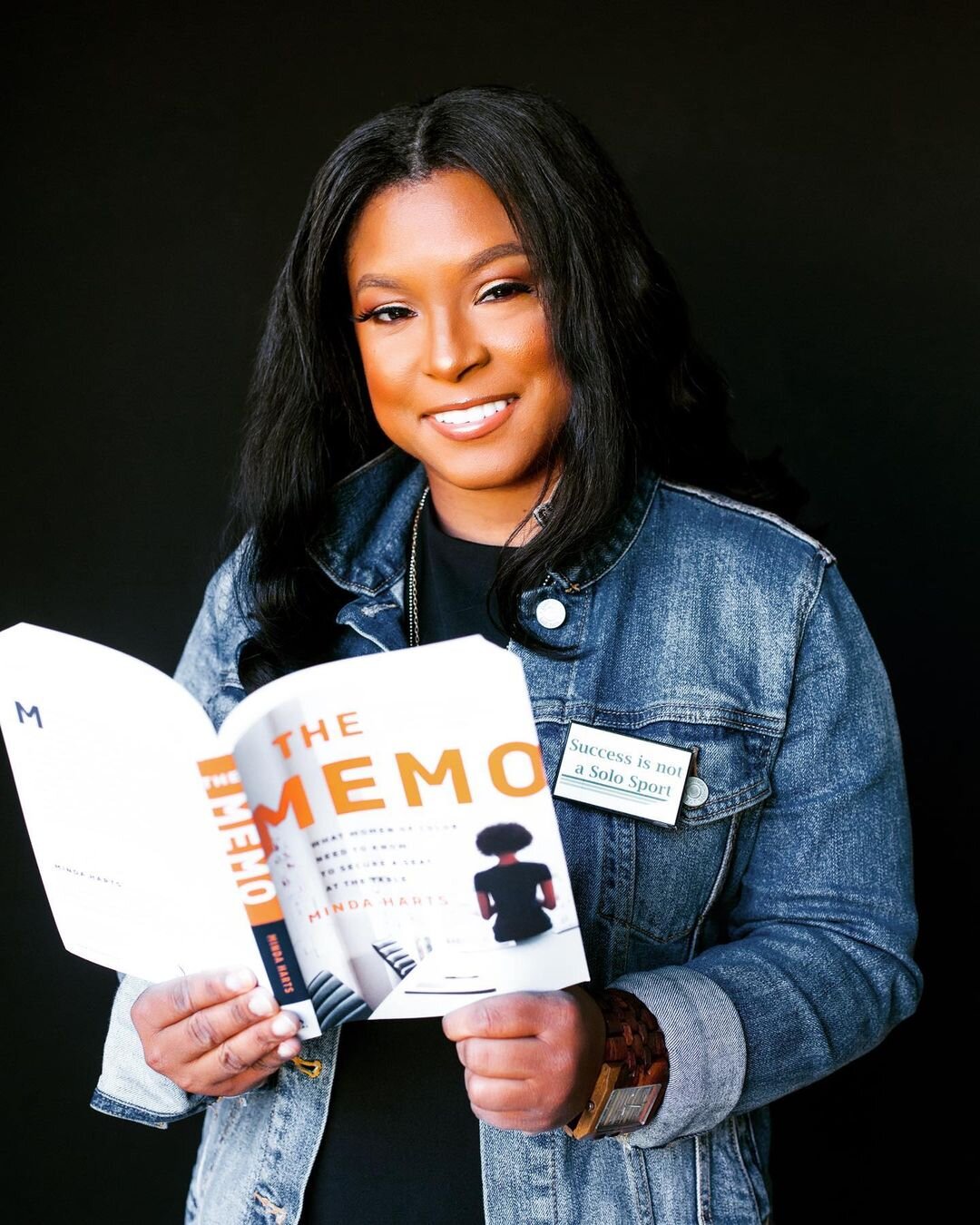

We spoke to Minda Harts, CEO of The Memo LLC, Professor of Public Service at NYU Wagner, and the author of The Memo: What Women of Color Need to Know to Secure a Seat at the Table.

Minda and I had the pleasure of meeting via Twitter (lol, so modern of us!) We followed each other years ago and it’s been such a pleasure to see her star rise and especially to see the success of her new book, THE MEMO. Her work is so transformational - you’ll be seeing a LOT more of Minda, so watch this space!

Meggie: Minda, I’m so excited to sit down and chat with you! Firstly, how would you describe yourself in one sentence?

Minda: A catalyst to make the workplace more equitable for women of color.

Meggie: That equity certainly can’t come soon enough. How did you get to where you are today?

Minda: I realized the workplace wasn't working for everyone and I wanted to be part of that change. At first, I was waiting on someone else to do it and realized I could use my voice and advocacy to inspire change. I couldn't wait any longer - It's time for more equitable workplaces.

Meggie: Coming to a point where you realized this was your life’s work, you must have had plenty of memorable experiences, could you tell us about a day at work you'll never forget?

“I deserved dignity and respect, and decided to choose myself.”

Minda: It was the day where I knew that I could no longer work in my current workplace. I was tired of surviving and not feeling like I belonged or was able to thrive. My manager was being unbearable and I finally chose myself and quit. I felt a sense of freedom that I wish I could bottle up and taste for the rest of my life. I deserved dignity and respect and decided to choose myself.

Meggie: You’ve grown a huge presence online and it’s grown even bigger since the release of THE MEMO your fab book. What’s your advice on growing a personal brand?

Minda: Always stay authentic to who you are. We need you, not a replication of someone else.

Meggie: YES! I couldn’t agree more. There is so much power in people’s own authentic story. So love your advice specially around negotiation - how do you prepare for negotiation conversations around salaries, promotions, and pay rises? What advice can you give the PepTalkHer audience?

Minda: I believe in role-playing various scenarios so that nothing shakes me during the negotiation. Being prepared has always served me well, no matter the outcome.

“Always stay authentic to who you are. We need you, not a replication of someone else.”

Meggie: Great advice! We talk a LOT about the power of preparation in our 5 Day Challenge actually, so super aligned there. To finish off, are you reading or listening to anything at the moment that’s giving you pause?

Minda: ‘Recalculating’ by Lindsey Pollak. She gives advice on shifting your mindset, setting goals, building your network, and getting the job that you want.

Meggie: Minda, thank you so much for chatting to us! So excited for your next book launch as well. Follow Minda on Instagram at @mindaharts and check out her book THE MEMO here - it’s super powerful, I highly recommend it - My copy is dog eared and highlighted throughout!

“Being prepared has always served me well, no matter the outcome.”

If you’re also keen to learn how to use Your Voice to Inspire Change like Minda does - I’d love you to join our Free 5 Day Career Challenge. Our SUCCESS SPRINT starts in a few weeks - sign up below to join!